Overview

On November 5, 2020, the federal government released new details on the Canada Emergency Rent Subsidy (CERS) and the Lockdown Support subsidy for commercial tenants. Both programs will provide eligible organizations with commercial rent and mortgage support until June 2021 and will serve as a replacement to the federal government’s Canada Emergency Commercial Rent Assistance (CECRA) program. Unlike the CECRA program, organizations eligible for CERS and the Lockdown Support subsidy will apply for and receive the subsidies directly, without needing the participation of their landlords. Legislation detailing eligibility requirements for the subsidy programs was introduced as Bill C-2 on November 2, 2020 and has not yet received Royal Assent. The government is initially providing the proposed details for the first 12 weeks of the program, until December 19, 2020.

Eligible Entities

Eligibility criteria for CERS would align with the Canada Emergency Wage Subsidy (CEWS). Eligible entities include individuals, taxable corporations, trusts, non-profit organizations, and registered charities. Eligible entities also include the following groups:

- Partnerships that are up to 50 per cent owned by non-eligible members;

- Indigenous government-owned corporations that are carrying on a business

- Registered Canadian Amateur Athletic Associations;

- Registered Journalism Organizations; and

- Non-public colleges and schools

In order to be eligible for the rent subsidy, organizations must either have a payroll account as of March 15, 2020, or have a business number as of September 27, 2020, and be able to satisfy the Canada Revenue Agency that the organization’s claim is bona fide rent subsidy claim. Additional eligibility requirements may be prescribed in the future.

Eligible organizations will be required to submit an application to the CRA no later than 180 days after the end of the applicable qualifying period. Details around CERS application process have not yet been released.

Qualifying Periods

CERS will apply to an organization’s qualifying rent expense incurred during any of the following qualifying periods:

- September 27 to October 24, 2020

- October 25 to November 21, 2020; and

- November 22 to December 19, 2020

The federal government may prescribe additional qualifying periods, with revised program parameters, following December 19, 2020 and ending no later than June 30, 2021.

Eligible Expenses

Eligible expenses for a location for a qualifying period would include commercial rent, property taxes (including school taxes and municipal taxes), property insurance, and interest on commercial mortgages (subject to limits), less any subleasing revenues. Any sales tax (e.g., GST/HST) component of these costs would not be an eligible expense. Eligible expenses would be limited to those paid under agreements in writing entered into before October 9, 2020 (and continuations of those agreements) and would be limited to expenses related to real property located in Canada. Payments made between non-arm’s-length entities would not be eligible expenses. Mortgage interest expenses in respect of a property primarily used to earn, directly or indirectly, rental income from arms-length entities would not be eligible. Expenses for each qualifying period would be capped at $75,000 per location and be subject to an overall cap of $300,000 shared among affiliated entities.

Calculating the base subsidy

CERS will apply retroactively to provide eligible organizations effected by COVID-19 with rent and mortgage support from September 27,2020 to June 2021. The subsidy rate will vary depending on the eligible organization’s revenue decline and will be calculated as follows:

| Revenue Decline | Subsidy Rate |

| 70% and over | 65% |

| 50% to 69% | 40% + (revenue drop % – 50%) x 1.25 |

| 1% to 49% | Revenue drop % x 0.8 |

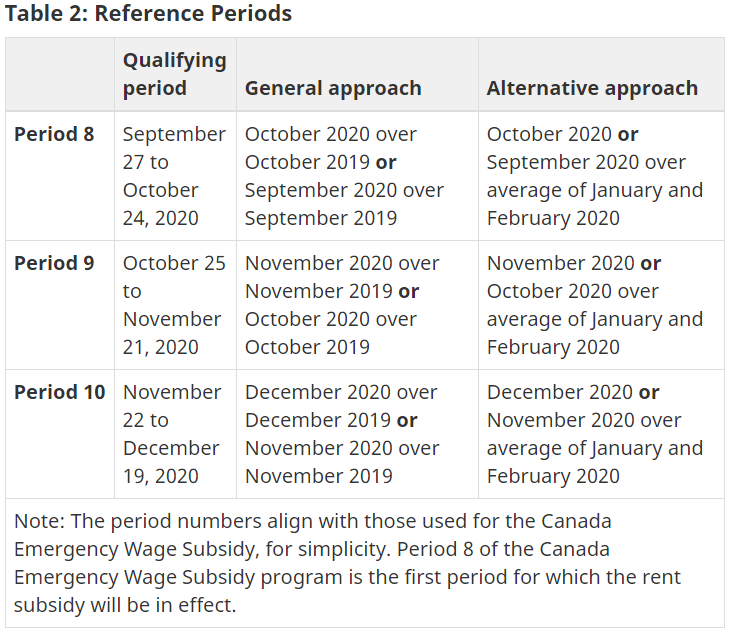

Reference Periods for the Drop-in-Revenues Test

Organizations are able to calculate their drop in revenue in one of two ways, but the basis of this calculation must remain the same for each of the three qualifying periods.

The first approach (General approach) for determining revenue decline is to compare the organization’s monthly revenue, year-over-year, for the applicable calendar month.

The second approach (Alternative approach) is to compare the organization’s current reference month revenues against the average of its January and February 2020 revenues.

An eligible entity would use the greater of its percentage revenue decline for the current qualifying period and that for the previous qualifying period in order to determine its subsidy rate.

Organizations are required to use the same approach in calculating revenue decline for the purposes of determining available support under the Canada Emergency Wage Subsidy program.

Source: Department of Finance Canada

Lockdown Support for organizations impacted by public health orders

Organizations which have been ordered to temporarily shut down or significantly limit their activities under a public health order will be eligible to receive an additional subsidy equal to 25% of the qualifying rent expense for each applicable qualifying period. This subsidy will also be available retroactively from September 27, 2020 until June 2021. In order to qualify, eligible organizations must meet the following criteria:

- Organization qualifies for the Canada Emergency Rent Subsidy, and;

- A public health order requires the organization complete down or cease some or all of the activities at a qualifying property for at least one week and it is reasonable to conclude that the creased activities were responsible for at least 25% of the revenues of the organization at that qualifying property.

For the purposes of the Lockdown Support subsidy, a qualifying rent expense is limited to $75,000 per qualifying property, but no overall limit will apply to the organization itself.

If an eligible organization is affected by a public health order only part of a qualifying period, then the Lockdown Support will be pro-rated for the number of days in the qualifying period during which the relevant qualifying property was affected by the public health order. Details around the application for the Lockdown Support has not yet been released by the federal government.

NOTE: The above program parameters for CERS and the Lockdown Support will apply until December 19, 2020 with future parameters to be adapted and revised thereafter.